Here is another article explaining an essential term related to investing. I know that financial jargon can get confusing, but understanding the terminology is a good first step when considering how best to save and invest your money, diversify your assets, and achieve specific financial goals. I get questions all the time about investment vehicles available to new and small investors, so in this article, we will explore the fundamental elements of a mutual fund and how you can invest in them in The Bahamas.

What is a mutual fund?

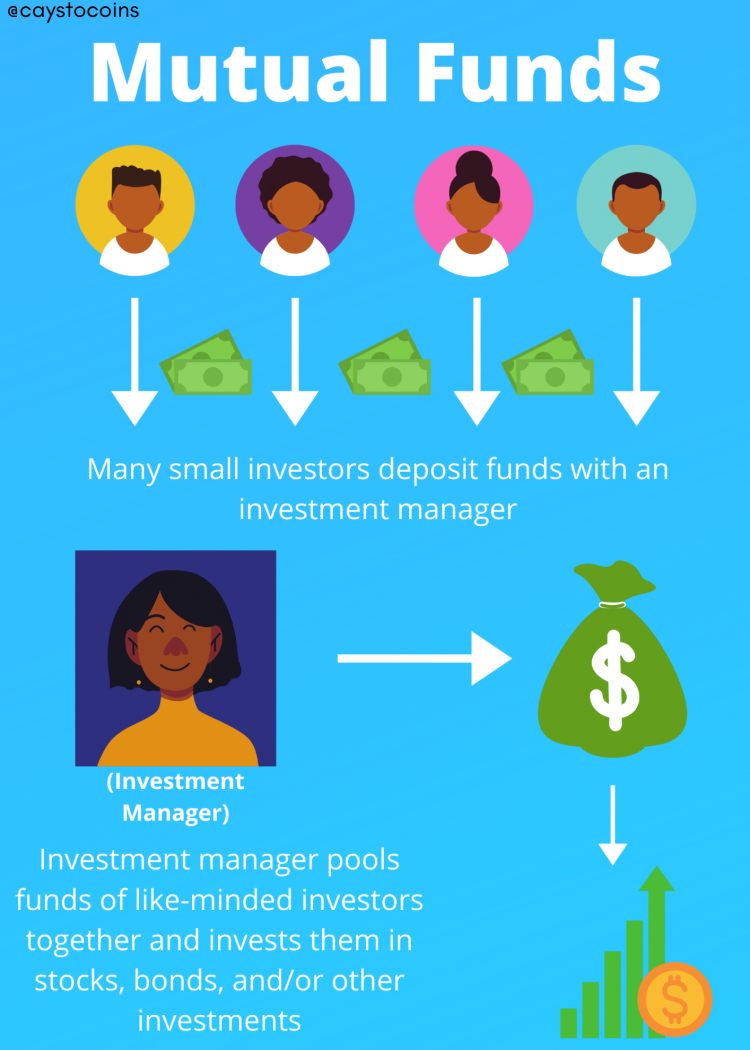

A mutual fund is an investment product in which an investment manager combines various stocks, bonds, and/or other securities into one portfolio for the benefit of multiple investors. Mutual funds are usually marketed to small investors who may not have enough money to make large personal investments. Each investor involved will receive their share of the profits that are reflected in the value of the fund (profits roll over in the fund). There is usually a built-in management fee for handling the mutual fund on behalf of the investors, which means the fee is deducted from the fund and is reflected in the overall value of the fund. It is important to note that individual investors do not own the actual stocks and bonds in the mutual fund, rather they own a share of the mutual fund.

To learn more about stocks and bonds, check out our article Investing 101: Stocks vs. Bonds.

"Understanding financial terminology is a good first step when considering how best to save and invest your money, diversify your assets, and achieve specific financial goals."

Cays to Coins Tweet

Categories of Mutual Funds

Broadly speaking, you can invest in four different types of mutual funds.

- Equity mutual funds – In the investment world, equity is defined as the ownership value in a company; therefore, these mutual funds consist of stocks. Equity mutual funds generally fluctuate more than other funds, meaning that the value of the stocks go up and down frequently, but this does not mean that investing in them is a bad idea. This type of fund can earn high returns over a long period; however, remember that the greater the risk, the greater the expected reward (or the potential loss).

- Fixed income mutual funds – These types of mutual funds typically invest in preference shares, government debt, and corporate debt. These mutual funds generally receive steady income in the form of periodic interest or dividend payments (hence the term “fixed income”). Examples of a fixed income security are a preference share or bond. A preference share is a type of stock that is paid a fixed dividend amount. If you want to better understand how bonds work, check out our article Understanding Government Bonds.

- Money market mutual funds – The money market simply refers to securities that are short-term (in terms of maturity) and very liquid, meaning that they can be turned into cash easily and quickly. Money market mutual funds are similar to fixed income mutual funds in that they invest in debt, but they only invest in short-term debt from governments and corporations. For better understanding, short-term debt is debt that typically matures/expires in less than a year.

- Balanced mutual funds (also referred to as hybrid mutual funds) – These types of funds invest in both equity and debt, which adds greater diversification to an investor’s portfolio.

All types of mutual funds can be further categorized, for example, by the value of securities, levels of risk, and region (e.g. domestic or international investments).

Advantages of Investing in Mutual Funds

- Mutual funds allow for diversification, which is an investment technique used to reduce risk in your portfolio. This is achieved by allocating investments among various factors, including different types of investments, industries, or region. Diversification makes you less dependent on the performance of a single stock or bond.

- Mutual funds allow you to begin investing without the high costs of an individual brokerage account.

- A professional investment manager manages mutual funds, so the tedious work of choosing stocks and bonds is done for you.

- Mutual funds usually keep a good amount of cash readily available in the event you need to withdraw your portion of the fund.

Risks to Consider

- If you invest in a fixed income fund, there is the risk that a bond held in the fund can default, which means that a bond issuer was unable to meet repayment obligations. This can negatively affect your returns.

- If you invest in a mutual fund that invests internationally, there is the risk that the value of your portfolio declines because of political or other issues in one or some of the jurisdictions.

- If you invest in an equity fund, there is the risk that one or some of the companies perform poorly and the value of the fund is negatively affected.

- With most mutual funds, redemptions, which entail selling shares for cash, are not made available immediately, which poses a certain level of liquidity risk. Be sure to ask your investment manager about the redemption period policy (the period when you can withdraw). Some mutual funds only allow you to withdraw on a certain day or during certain months with prior notice. Notice is needed because the investment manager needs time to ensure that cash can be made available to you without disadvantaging other investors in the fund.

Avenues to Invest

In The Bahamas, you can inquire about mutual funds at regulated investment firms. It is very important to remember that any firm claiming to offer mutual fund services must be registered with the Securities Commission of The Bahamas. It is important to shop around to find the best fit for you. In no particular order, below is a list of all investment firms (to my knowledge) that offer mutual funds to the average Bahamian consumer:

- LENO Bahamas

- Colina Financial Advisors Ltd.

- Royal Fidelity

- Investar Securities Ltd.

N.B.: If you know of a firm that is missing from this list, feel free to let us know in the comment section.

If you are unsure about a particular mutual fund, here are some questions you can ask your investment manager to help you understand if a product is for you:

- If I need to withdraw funds, when and how can I do that?

- What type of securities are in this mutual fund?

- What is the level of risk associated with this mutual fund?

- How and how often can I add money to the mutual fund?

Final Thoughts

Mutual funds are a great way to begin building your personal investment portfolio because the hard work of choosing investment opportunities is done for you and they allow for diversification opportunities. If you are interested, meet with or call an investment manager who can assist you and help you choose the best type of mutual fund for you by assessing your financial goals and your risk appetite and tolerance. Be sure to conduct your own research before making a final decision.

Note: This article does not serve as official investment advice; it is simply an explanation of terms for new investors.